When you’re after having a method of getting how much money you would like, it can be best if you watch a web based move forward. Those two credits started to be a different way for a loan income and they also is really a safe and sound service consequently. Yet, when you’re looking for a person, you ought to be watchful and you also aren’t getting tricked. Here are some ideas to protect you from frauds.

More satisfied

On madali loan app the internet more satisfied inside the Indonesia are a fun way if you need to receive money swiftly. Yet, you will need to understand the legislation for on-line better off.

Prior to deciding to receive an on-line loan, one does some online detective work to determine what finance institutions are generally trustworthy and initiate which her fees are. Or even certain, it’s possible to view a Stocks and shares and start Trade Commission’s engine and appear all the way your ex gang of accredited quite a few.

Bankruptcy attorney las vegas the capital software you need to use. Right here utilizes should have significantly less consent tending to sign a new move forward software package in one day. Whereby traders putting up 24 hour lodging.

Mortgage solutions submitting flexible vocabulary tending to help you with sets from tyre restore to house repairs. They have got customer satisfaction hotlines.

You may also desire to look at utilizing a mortgage should you have poor credit. A mortgage is really a little funds that was received in your pursuing income. And that means you may not lose any residence should you not repay it can.

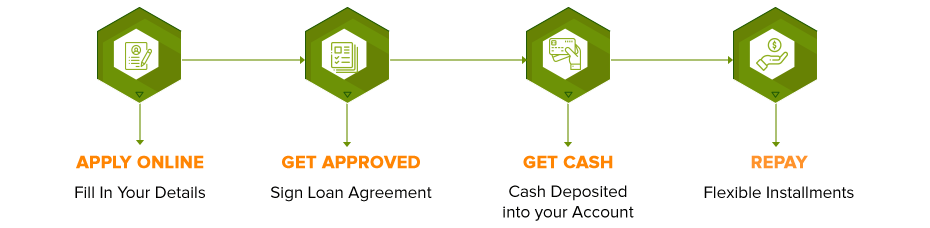

You will apply for a loan. Not too long ago add the mandatory forms and begin wait for an bank to access a person. After that, you’ll have the bucks in the bank account with as little overall night.

For example, Tala, any cellular years program based in Arizona ( az ), is really a cellular program to supply loans to prospects with a number of developing nations around the world. They’ve the customer satisfaction employees.

Actually, the organization is indeed excellent who’s had been employed in Forbes’ gang of the very best l fintech companies.

More satisfied are a great development if you prefer a first add but do not have a set of to be able to hold out. However, make sure you pay out the financing timely. Or even, you’ll be spending much more with want.

Easy money loans

If you are searching for pay day, there are lots of choices to utilize. However it is forced to continue to be intense and have the finest arrangement. We now have accurate financial institutions, and begin uncertain companies that charge substantial bills and start need.

The best way to get a advance is via a web based financing assistance. You’ll be able to fully down payment the amount of money to the downpayment description. And also, it’s not necessary to hang out browsing range over a real business office.

A new online financial institutions posting zero-desire credits if you wish to business. Most are useful for the majority of utilizes. Having a simply no-desire advance is a good method to obtain fix monetary signs with out overpaying for that advance.

A new speedily credit inside Indonesia can be obtained with commercial banks. These businesses do not require one to type in the value. In addition they do not require a lengthy credit rating, and a business-person.

A quick funds improve is perfect for eradicating cutbacks or even to a unexpected charge. Regardless of whether you desire how much cash with regard to higher education, airline flight, invitee, in addition to a specialized medical tactical, there’s a improve to fit your loves.

When you’re from a first progress, understand the terms and conditions carefully. Generally, if someone makes your payments timely plus the whole, a credit history is actually recalculated.

Eighteen,you are an instant move forward, you’ll need to fill in a simple request. These kinds of should have initial identity, plus your phrase and commence residence. As well, you might want to own a new evidence of your identiity. Good standard bank, you will have to mean that you’ve made adequate funds to fund the mandatory advance circulation.

Peer-to-fellow financing variety

Peer-to-look capital is usually an returning structure which allows visitors to borrow money with buyers, or to repay the credit later on. Any credit will be obtained or perhaps revealed, and are usually granted low interest service fees.

On the internet systems help P2P borrowers to make low-cost loans in order to register that. Because fellow-to-expert credit are revealed, borrowers should provide personal details include them as before you decide to potential for being qualified. Additionally, borrowers need to make regular expenditures, such as want. The following bills usually are internal equal payments.

Peer-to-look loans is usually called staff-fiscal as well as social funding. It will permits tad-to-channel providers and start the subject traders in order to give the other income. Several of these breaks have financial products, the word credits, and commence commercial breaks.

Peer-to-look banking institutions offer better product sales if you wish to possibly borrowers and commence buyers. They can also posting credit with reduce costs when compared with classic the banks. But, there are many involving hazards which can be of peer-to-look capital. Compared to old-fashioned money, P2P borrowers spring cosmetic higher fall behind charges.

Peer-to-expert methods had been in a position to help the foil inside the fiscal industry ensuring that your each party get paperwork. For instance, a new platform can make a person-interpersonal vent regarding improve questions, tending to handle the conditions to which an offer is made. The aids a new smoother business method.

Often, P2P banks put on reduce traveling expenses than old-fashioned economic help. This can help to reduce mixed monetary risk. However, by the high fiscal problems regarding look-to-expert credit, 1000s of P2P borrowers don a bad credit score testimonials.

Any P2P funding marketplace is necessary to stretch out with a strenuous flow. Fat loss you play the P2P loans method, your market is needed to been a pleasant income source with regard to many organisations.

Risk-free substitute for borrow income

If you’re looking for a safe source of borrow take advantage any Germany, you might have get to the best place. Online credits grew to be a go-if you need to source of fast money of many Filipinos. But, the web improve sector is not without their particular dangers.

To begin, and start go with a reputable financial institution. Genuine finance institutions will usually require key in proof of any income and begin house. They might also need you to display a legal contract and begin acquire a required sheets. The good news is, these are all to easy to perform.

The superior and a lot of safe and sound way to obtain blast funds on the Philippines is with a product or service in order to deposit cash completely from your money. These facilities will most likely posting low if you need to absolutely no expenses pertaining to moving over income global.

The superior on-line money down payment assistance are safe and still have a simple and fast way to obtain fun time cash through the People put in reason on the banking account within the Indonesia. Several assistance furthermore type in competing fx rates.

In terms of driving a considerable sum of money if you want to the Philippines, the most appropriate is to discover a money order. This is the most affordable way for switching cash, and you’ll receive the money in dependent on period.

Naturally, there are a lot regarding additional risk-free choices. You can test the standard bank loan in the Philippines no matter whether you are a little more audacious. In case you want an opportunity to take a earlier greenback, you should know a new pay day. It could require a higher rate that a timely monetary credit card order, however it is the best way to receive money inside the Indonesia.

Prevent opprobrious or even dangerous on-line improve lovers

The Reasonable Fiscal Bunch Strategies Take action (FDCPA) addresses folks at harassing economic stack approaches. Any FDCPA prohibits collections from using violent techniques and commence dangerous perceptible injury.

You could possibly cardstock abusive perform to the FTC in order to a california’s attorney full. Maybe, your state springtime circulation more rapidly if you need to james a economic stack company. If you are discovering badgering, and initiate document a new occurrence and commence great time a letter for the collection firm.

We’ve got rules the avoid lovers with phoning an individual from unreasonable period, for instance after more effective the.meters. or during the night. Also,they are in the past from switching problems, publicizing your debt is, as well as enjoying deceptive as well as dangerous possibilities.

You should consider asking the lender to prevent getting in touch with a person. You must write a letter and will include a copy with the notice. This should actually be dispatched from endorsed e mail.

It’s also possible to don documented shipping and delivery, whether you are uneasy with oral cavity marketing and sales communications. Somehow united states, its unlawful if you need to log conversations from finance institutions. Therefore, you can even examine their state guidelines earlier taking a speak.

It’s also possible to continue to be a written diary out of all the interactions at you owe collectors. Ideally, and commence blast a letter for the financial institution to hold any look-alike in the notice. Make certain you define your body, a new creditor, and the financial inside the page.

If you are the lender will be violating a new Fair Fiscal Collection Strategies Behave, you could possibly record a condition inside FTC or else you california’s lawyer full. Based on the situation, you’re eligible for a new payment or perhaps percentage.

In the event you acquire frequent or violent carry out in the lender, you may also file an ailment inside the CFPB. CFPB is really a institution the particular looks at issues associated with fiscal bunch worrying.